Understanding Bank Owned Properties and Buying Guide

Outline and Why Bank-Owned Properties Matter

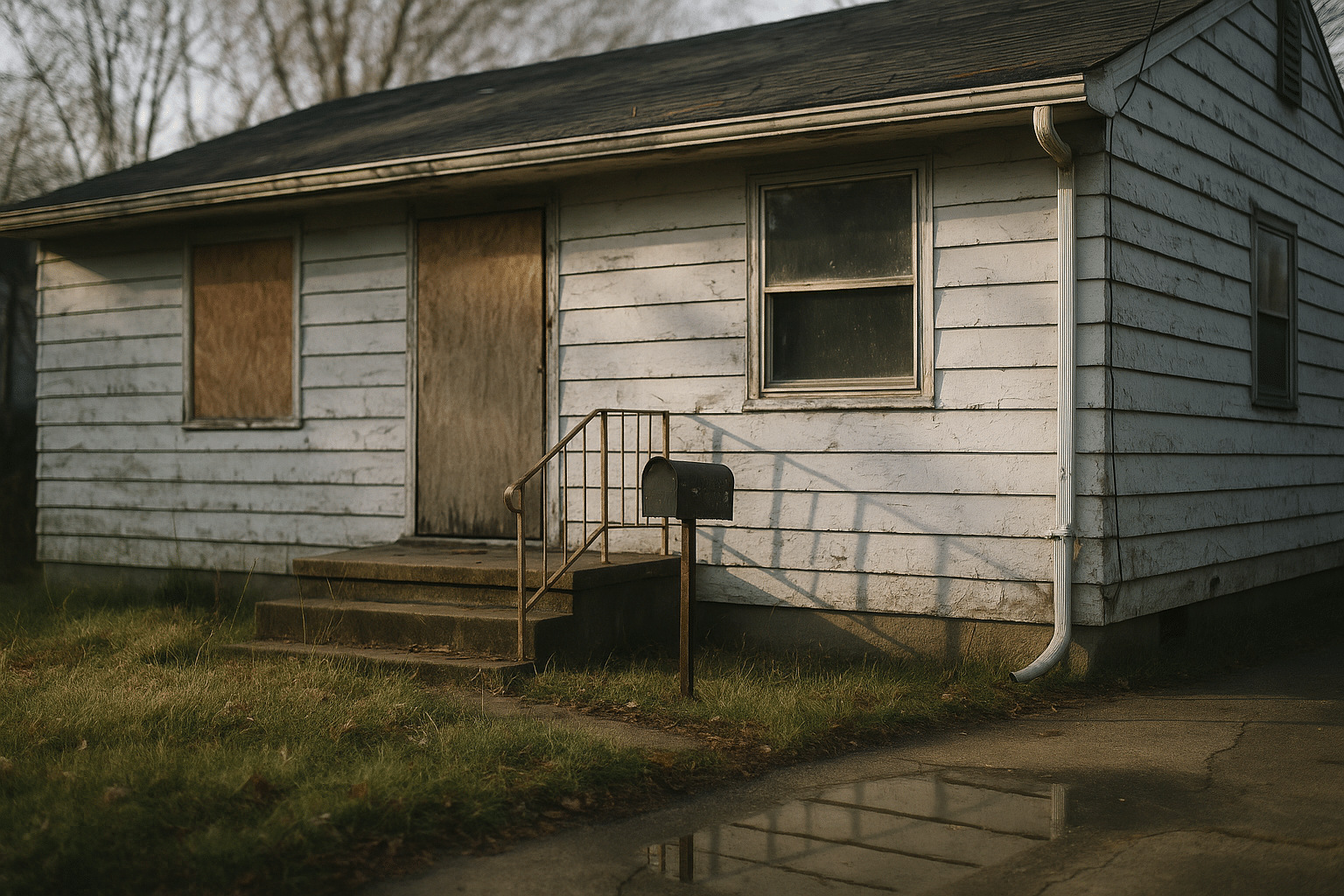

Bank-owned properties—often called real-estate–owned (REO) homes—sit at the intersection of opportunity and responsibility. They can offer pricing that reflects needed repairs, flexible timing compared with courthouse auctions, and a clearer path to clean title. Yet they also come with “as-is” conditions, firm seller addenda, and a paper trail that must be read with care. In other words, this corner of real estate rewards diligence over speed, planning over impulse, and a cool head over wishful thinking.

This guide begins with definitions and context, then builds a practical playbook you can adapt to your market. The objective is simple: give you enough structure to evaluate a bank-owned listing from first glance to final signature, without glamorizing risk or glossing over work. Expect plain language, examples you can rerun with your own numbers, and checklists that double as on-the-ground action items.

Here’s the roadmap we’ll follow, along with what you should take away from each part:

– Foundations: How properties become bank-owned, how this differs from pre-foreclosure, auction, and short sale, and why that distinction matters for price, access, and title clarity.

– Preparation: Budgeting, financing, and deal screening, including simple metrics that help you reject weak leads quickly.

– Due diligence: Inspections, title work, utilities, insurance, and code compliance checks, plus a framework to estimate repairs with contingencies.

– Offer and negotiation: Positioning your price, setting contingencies, handling multiple offers, and planning for appraisal issues.

– Closing and execution: Timelines, documents, closing costs, and a post-close punch list so the property starts working for you—not the other way around.

Why now? Inventory cycles ebb and flow, but bank-owned listings surface in every market at some cadence. Discounts vary widely by region and condition; many transactions land in the single-digit to mid-teens percentage below comparable non-distressed sales, while heavier fixer-uppers can stray further. Your outcome will rely less on chasing headlines and more on methodical analysis: what you can verify, what you can fix, and what the numbers allow you to carry. Consider this your field guide, designed to help you make steady, informed moves.

What “Bank-Owned” Really Means (and How It Differs)

Properties do not wake up one morning as bank-owned; they pass through a sequence. First comes delinquency and pre-foreclosure. If no resolution occurs, an auction is scheduled. When an auction does not yield a satisfactory bid, the lender takes title and the home becomes bank-owned. That status change matters. Access typically improves once the property is in bank inventory; you can often schedule interior showings and run inspections that are impossible during courthouse sales. Paperwork changes too: bank addenda and disclosures replace owner affidavits, and the seller’s knowledge is limited because they have not lived in the home.

Compared with auction purchases, bank-owned acquisitions trade some pricing edge for information. You usually have more time, more data, and a more standardized process. Compared with short sales, you avoid the uncertainty of multi-party approvals. Compared with typical retail listings, you face stricter “as-is” terms and fewer concessions. Title risk is often reduced relative to auction buys because junior liens may have been addressed during foreclosure, but “reduced” does not mean “removed.” You still confirm taxes, municipal liens, association balances, and any clouds that could delay resale or refinancing.

Pricing behavior follows patterns. Many bank-owned listings debut near market value adjusted for visible condition, then drop in measured steps if activity lags. Days on market vary widely by region and season; colder months and softer submarkets can see longer exposure, while entry-level price points in tight areas may attract multiple offers quickly. Carrying costs motivate banks to sell, but not at any price. They weigh list-to-sale ratios, repair trade-offs, and portfolio timelines.

Consider a simple scenario. Suppose comparable renovated homes are selling around 300,000. An REO lists at 255,000 with obvious deferred maintenance: roof near end of life, dated mechanicals, peeling exterior paint. Your contractor estimates 35,000 for essentials and 10,000 for interior refresh. After transaction costs, your all-in might approach 305,000. If rents or resale margins justify the spread, the deal can still pencil—especially if you balance durable upgrades against cosmetic ambitions. The lesson: bank-owned does not automatically equal bargain; careful math reveals when a discount is meaningful versus merely noisy.

Preparation: Money, Search Strategy, and Fast Screening

Before chasing listings, you set your boundaries. Define a budget that includes more than the sticker price: closing costs, insurance, taxes, utilities during hold, and a repair contingency. Many buyers reserve 10–20% of the rehab estimate for surprises. Secure pre-approval early; some lenders have overlays for distressed properties, occupancy rules, or limits on the extent of repairs. If the home needs significant work before move-in, explore renovation-friendly financing or plan for interim housing. Cash offers can simplify timelines, but financed buyers win every day with clean terms and realistic dates.

Your search sources should be broad and consistent. Bank-owned homes appear on multiple listing services, public auction result feeds, county postings, and brokerage sites with REO filters. Cast a regular, repeatable net: daily alerts, weekly driving tours through target neighborhoods, and periodic checks of public records for recent foreclosures transitioning to bank ownership. Track each lead in a simple spreadsheet with fields for address, list price, estimate of after-repair value, repair budget, days on market, and notes from showings or calls.

To screen quickly, lean on a few practical metrics:

– After-repair value (ARV): anchored to recent comparable sales adjusted for size, condition, and features.

– Cost-to-value ratio: rehab budget divided by ARV; lower ratios tend to be easier to finance and manage.

– Cushion to exit strategies: resale, refinance-and-hold, or long-term rental; can you pivot if one path stalls?

– Stress test: add a modest overrun and a longer timeline; does the deal still survive?

Documentation and team readiness also matter:

– Pre-approval letter or proof of funds tailored to the price range.

– A contractor who can deliver a line-item estimate quickly.

– An inspector familiar with vacant properties and common winterization quirks.

– An insurance broker who can quote policies for unoccupied dwellings or properties with older systems.

Finally, be honest about your bandwidth. A home needing foundation work, roof replacement, and electrical updates is a project, not a weekend hobby. There is no prize for signing the first contract you see. There is value in walking away from three mediocre leads to focus on one that aligns with your skills, schedule, and financing. Preparation is not paperwork; it is the art of removing avoidable surprises.

Due Diligence: Inspections, Title, Risk, and Repair Math

Once you identify a promising home, due diligence starts the clock. Vacant properties develop issues that lived-in homes avoid: slow leaks, vandalism, pest intrusion, and deferred maintenance. Begin with a thorough inspection and, where needed, bring specialists: structural, roofing, plumbing, electrical, and HVAC. Winterized homes may hide problems; schedule de-winterization if allowed, and confirm systems operate under pressure. Look for staining around ceiling penetrations, double-tapped breakers, outdated panels, corroded supply lines, hidden junction boxes, and signs of movement at foundation cracks.

Title work runs in parallel. Order a title search to confirm ownership chain, recorded liens, encroachments, easements, unpaid association dues, and municipal fines. Vacant houses can accumulate nuisance liens from weeds or unsecured doors; small balances still delay closing. In areas with private utilities, verify balances for water, sewer, or gas that may attach to the property. Ask about prior permits; unpermitted additions can complicate insurance and resale. If a homeowners association is involved, request estoppel or payoff statements and review rules affecting rentals, parking, or short-term stays.

Repair math turns observations into numbers:

– Build a scope of work by system: exterior envelope, structure, mechanicals, interior finishes, site/drainage.

– Apply unit costs where possible: roofing per square, flooring per square foot, fixture counts for baths and kitchens.

– Add mobilization, disposal, and sales tax; small line items add up.

– Layer a contingency; older homes often reveal concealed conditions.

– Sequence work to protect the schedule: roof and exterior first, then rough trades, then finishes.

Insurance and risk controls deserve attention. Some carriers limit coverage on vacant dwellings or require specific locks, smoke detectors, and secured windows. Budget for utility activations and temporary heat or dehumidification during repairs. In certain locations, consider tests for radon, sewer line scoping, or termite inspections. If the property sits near water or in a mapped flood zone, price appropriate coverage and check elevation certificates. Document everything with photos and dated notes; they support negotiations, draw schedules, and future disclosures.

Offers, Negotiation, Closing Timeline, and Actionable Conclusion

When you draft an offer, let data carry the weight. Anchor your price to recent comparable sales and a transparent repair budget, then document your assumptions in concise notes. Bank sellers often require their own addenda, which may limit repairs, cap credits, or set penalties for missed dates. Keep your contingencies focused: financing, appraisal, inspection, and clear title. Shorten timelines you control—such as inspection scheduling—while allowing realistic buffers for lender underwriting and appraisal availability.

Multiple-offer situations do occur. If you raise price, consider protecting yourself with a ceiling via an escalation structure tied to verifiable competing offers. Strengthen the package with clean formatting, complete signatures, and proof of funds or a fresh pre-approval. Earnest money signals seriousness; align it with local norms and your risk tolerance. If the appraisal lands short, you can renegotiate, bring additional cash, adjust credits, or pivot to a renovation loan where eligible. Do not waive critical protections unless you can afford the consequences.

Expect a timeline that runs roughly 30–45 days for financed purchases and shorter for cash, with variation by market. Common milestones include seller addenda execution, inspection period, appraisal order, final underwriting, and clear-to-close. Closing costs can include title insurance, recording fees, lender charges, prepaid taxes and insurance, and association transfers where applicable. Before funding, confirm utilities for post-close access, schedule contractor start dates, and compile a punch list for day one: secure locks, address safety hazards, and stabilize any roof or water issues immediately.

Conclusion and next steps:

– Define your buy box: property type, price range, and neighborhood constraints.

– Assemble your team and documents before you write offers.

– Build a repeatable screening system; let weak leads fall away without emotion.

– Treat due diligence as an investment, not an expense.

– Keep a calm, numbers-first approach to negotiation and timelines.

For first-time buyers, the value lies in structure: clear steps, guarded contingencies, and a willingness to pause when the numbers disagree. For small investors, the win is repeatability: deals that fit your model, verified by data, delivered by a rhythm you trust. Bank-owned properties reward patience and preparation; with a grounded plan and measured pace, you can turn a vacant house into a stable asset without turning your life upside down.